Brownfield Land Development

Advantages and Disadvantages, with Comparison to Greenfield and Greyfield Development.

Brownfield land development has emerged as a pivotal aspect of sustainable urban planning, addressing the challenges of urban sprawl and environmental degradation. In this article, we will explore the intricacies of brownfield development, delving into its advantages and disadvantages, while drawing comparisons to the more conventional approach of greenfield and the recently coined greyfield development.

Understanding Brownfield Land

Brownfield land refers to previously developed sites that have become underutilised or abandoned, often due to changing industrial practice or contamination from former use. These sites pose unique challenges and opportunities for redevelopment, making them a focal point for urban planners and environmental specialists.

Advantages of Brownfield Development

1. Optimal Land Use: Brownfield development allows for the repurposing of existing infrastructure, making efficient use of land within urban areas. This reduces the pressure on green spaces and preserves natural habitats.

2. Infrastructure Accessibility: Brownfield sites are typically well-connected to existing infrastructure, such as roads, utilities, and public services. This accessibility facilitates cost-effective development and minimises the need for extensive new infrastructure.

3. Urban Revitalization: Transforming brownfield sites can breathe new life into urban areas, fostering community growth and economic revitalization. The redevelopment of these sites often leads to increased property values and attracts businesses, creating a positive impact on the local economy.

4. Environmental Remediation: Brownfield development presents an opportunity to remediate contaminated land, mitigating environmental hazards and restoring ecosystems. This not only benefits the immediate surroundings but can contribute to the overall improvement of environmental quality.

5. Regulatory Support: Companies acquiring contaminated or derelict land can claim an enhanced deduction of 50% or 150% against corporation tax for the remediation costs. This relief can also be claimed on past developments.

Disadvantages of Brownfield Development

1. Environmental Challenges: Brownfield sites are often contaminated with hazardous materials, posing significant environmental challenges. Cleanup efforts can be costly and time-consuming, requiring specialised knowledge and technology to ensure effective remediation.

2. Uncertain Costs: The extent of contamination and the complexity of cleanup processes can lead to unpredictable costs. Developers may face unexpected expenses, impacting the financial feasibility of brownfield projects.

3. Community Opposition: Some communities may resist brownfield redevelopment due to concerns about environmental risks or changes to the character of the neighbourhood. Community engagement and transparent communication are crucial to address these concerns.

4. Limited Space: Brownfield sites, while advantageous in reusing existing infrastructure, may have limited space compared to greenfield developments. This constraint can limit the scale and scope of projects.

Comparison with Greenfield and Greyfield Development

1. Greenfield Development:

Advantages: Greenfield development offers a clean slate, allowing for large-scale planning without the constraints of existing structures or contamination. It provides ample space for expansive projects and is often seen as a straightforward option with fewer unknowns.

Disadvantages: The environmental impact of converting undeveloped land into urban areas can be significant. Greenfield development may also require extensive new infrastructure, increasing costs and impacting natural habitats. There may be significant public objection to development on greenfield sites.

2. Greyfield Development:

Advantages: Greyfield is a newish term referring to sites which lie within the designated greenbelt but have history of commercial or industrial use and are now derelict or underused. Such development allows for the repurposing of and efficient use of land. It reduces the pressure on green spaces and preserves natural habitats. Greyfield development presents an opportunity to remediate contaminated land, mitigating environmental hazards and restoring ecosystems. Tax relief may be available.

Property Wire has reported on an investigation by Frank Knight which found:

"Knight Frank identified over 11,000 grey belt sites comprising less than 1% of the green belt, which do not include agricultural or residential uses.

Together these grey belt sites sit on land totalling 13,500 hectares ...

This land could be used for approximately 100,000 new family homes, potentially rising to over 200,000, ..."

Disadvantages: Similar to brownfield development, greyfield sites may require environmental remediation. Additionally, they might lack the connectivity and accessibility of brownfield sites in urban areas.

Conclusion

In the realm of sustainable urban development, brownfield land holds immense potential for addressing the challenges of growing populations and urbanisation. While brownfield development comes with its set of challenges, the benefits, including optimal land use, infrastructure accessibility, and environmental remediation, can make it a viable and attractive option. By comparing it with greenfield and greyfield development, we gain insights into the unique advantages and considerations associated with each approach. As we navigate the complexities of urban planning, brownfield development stands out as a key strategy for creating vibrant, resilient, and environmentally conscious communities.

In order to go forward any project has to be financially viable. The importance of having an experienced partner to assess the available information and advise on potential remediation cannot be overstated. For those willing to take the time to assess the risk there are opportunities to create successful developments. As they say in Yorkshire "Where there's muck there's brass".

Embedding Nature for Business Resilience

The Environment Analyst have produced a Corporate Guide: Embedding Nature for Business Resilience. We hope will encourage and enable an approach that goes beyond the bare minimum of remedial works but seeks to enhance the natural environment to the benefit of us all.

The Environment Analyst says:

"Emerging frameworks will see investors attach significant weight to the value of nature-based reporting and action to safeguard habitats. Meanwhile, asset owners are utilising nature-based solutions to develop resilience to climate change.

Environment Analyst’s free Corporate Guide was written by subject matter experts and seasoned environmental and sustainability advisers to give corporations the insights they need to embed nature-based solutions for business resilience. Download the guide now and learn how to navigate and prepare for the emergence of new nature reporting requirements and the development agenda."

Nitrogen and Phosphorus Nutrient Neutrality

The much discussed issue of nutrient neutrality affects 74 local authority areas in various parts of the country. Excessive levels of phosphates and nitrates contribute to the growth of algal blooms, which causes reduced oxygen levels with adverse impacts on aquatic life.

There are ways of achieving nutrient neutrality however practically and cost are the issues. For on-site solutions the natural options of fallow land and wetlands are generally impractical due to lack of space and the cost of treatment plants renders this out of reach for any but the largest schemes.

Off-site options are often therefore considered. Natural England requires mitigation to be provided within the same local catchment area as the development and to be maintained for a minimum of 80-125 years.

There are many excellent articles dealing with the issue in depth, here are three useful ones by Environment Analyst , Michelmores and JDP.

Its our Birthday! We are celebrating 20 years this month!

Its our Birthday! We are celebrating 20 years this month. The journey has been nothing short of incredible. The steadfast support from our esteemed employees and clients has fueled our growth.

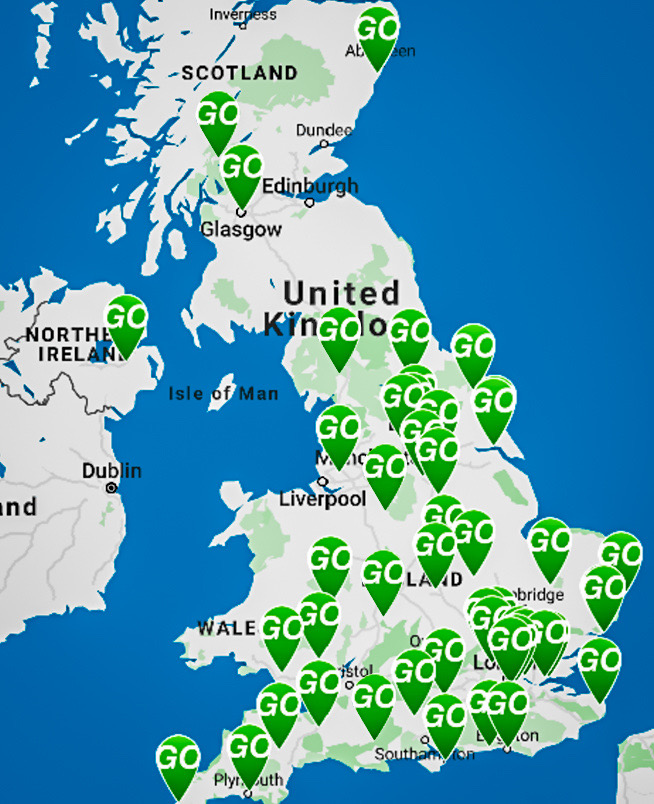

Founded by our Managing Director, Peter George, in 2003, GO Contaminated Land Solutions has evolved into a diverse team with backgrounds in a range of disciplines working together with a commitment to excellence.

Peter is a Chartered Civil Engineer who has worked internationally and returned to the UK where he has worked for contactors, the public sector, and consultants, gaining a wide experience within the built environment with a focus for the last twenty years on environmental services related to the redevelopment of contaminated land.

Driven by a vision of integrity, cost-effective practical advice, and creating safe environments, we've operated across the UK and had the pleasure of collaborating with a diverse clientele.

Since 2003 we have:

- Expanded services from contaminated land conditions from phase 1 desktop studies, phase 2 site investigation, phase 3 remediation strategies and phase 4 verification reports, monitoring to flood risk assessments, Basement Impact Assessments, drainage strategy and WAC testing.

- Collaborating with a range of clients including developers, consulting engineers, housing association, surveyors, project managers, homeowners, contractors, solicitors, local authorities, property agents and architects.

- In 2018 we rebranded with a refreshed logo

- In 2022 we have a new refreshed website @ www.gosolve.co.uk

- We have achieved CHAS advanced accreditation.

- Notable charitable contributions, including support for Sydenham Garden mental health initiatives.

To our dedicated employees and supportive clients, we extend our heartfelt gratitude. As we look forward to continued growth, our commitment remains unwavering – delivering the best services with our wealth of experience to ensure optimal project outcomes.

Thank you for being an vital part of our journey. We would love to hear from you! Please share your thoughts and feedback on our services, and newsletters.

What is a Phase 1 Environmental (or Contaminated Land) Report and why is it necessary?

A Phase 1 Environmental Report provides information on the environmental condition of a site and helps buyers, lenders and developers make informed decisions about their investment or proposed development. In this blog post, we'll discuss what a Phase 1 Environmental Report is, why it's necessary, and how it works.

A Phase 1 Contaminated Land Report is a preliminary risk assessment used to identify potential sources, pathways, and receptors of contamination. It may be required as part of a planning application or to discharge a planning condition imposed by a Local Planning Authority. It may also be requested by The National House Building Council (NHBC) in support of a building warranty, or by a lender as part of a mortgage application.

Phase 1 reports are typically prepared by environmental consultants and involve a review of historical records, such as old maps, photographs, and planning applications, to identify potential sources of contamination. This will include past industrial uses of the site, nearby landfills, or other known contaminated sites. The consultant will also conduct a site walkover to identify any visible evidence of contamination, such as odours, staining or discoloration of the ground or water. Where possible interviews will be conducted with current and past site owners, occupants, and neighbours to gather information about the site's environmental history and potential risks.

Once the potential sources of contamination have been identified, the likelihood of contamination occurring will be assessed and the potential risks to human health and the environment. This will involve considering the type and quantity of contaminants, the geology and hydrology of the site, and the presence of any sensitive receptors, such as residential properties, schools, or water bodies.

If the Phase 1 report identifies a potential risk of contamination, further investigations will be recommended. These may include intrusive sampling and analysis of soil and groundwater or monitoring for ground gases and vapours. This will be necessary to determine the nature and extent of the contamination and to develop a remediation plan.

Phase 1 contaminated land reports are important because they help to ensure that land is developed in a safe and sustainable way. By identifying potential sources of contamination early on, developers can avoid costly delays and problems further down the line.

Here are some of the benefits of having a Phase 1 contaminated land report:

• It can help to identify and assess potential risks to human health and the environment.

• It can help to avoid costly delays and problems during development.

• It can satisfy the requirements of planning authorities and other stakeholders.

• It can increase the value of a property.

If you are planning to develop land, it is important to have a Phase 1 contaminated land report prepared by a qualified environmental consultant.

For questions or queries about the Phase 1 Environmental Report, call GO Contaminated Land Solutions today on 020 8291 1354.

Minimising Delay in Discharging Contaminated Land Planning Conditions

Why Are They Imposed?

Local Planning Authorities (LPAs) usually impose a number of planning conditions on the granting of planning permission. When a site or surrounding area has a history of industrial or potentially contaminating uses a contaminated land planning condition will be imposed. These conditions aim to ensure that the land is suitable for the proposed use and does not pose any risks to public health or the environment.

Pre-Application

The first step to minimising delay is to find out at the pre-application stage if a contaminated land planning condition will be imposed. A phase 1 desktop study can then be submitted with the planning application which means one less stage on granting of planning permission.

If the phase 1 desktop study advises that there will be no significant elevated risk and the LPA agree then there will be no need for a contaminated land planning condition. If on the other hand a potential elevated risk is identified the remaining stages will be conditioned.

Contaminated Land Condition Stages

To discharge a contaminated land planning condition, several key steps and requirements must typically be met. Phase 1 desktop, phase 2 intrusive investigation and phase 3 remediation strategy are usually pre-commencement conditions with phase 4 verification being a pre-occupation condition.

Phase 1 – Desk Study Report

As noted above either as part of the applications or on granting of permission a Phase 1 – Desk Study Report is required. This is a preliminary risk assessment, including a site walkover, to determine the potential for contamination. The report will include:

- Historical maps and site uses.

- Environmental setting, including geology, hydrogeology, and hydrology.

- Potential contaminative sources, pathways, and receptors.

- Recommendations for intrusive site investigations, if necessary.

Typically we advise clients that this can be completed in 15 working days but this timescale can be reduced where necessary.

Site Investigation Scheme

Some LPAs specify that a site investigation scheme is submitted and approved prior to the investigation. In any event we recommend this approach to ensure that the LPA approve of the scope. Should the LPA decide that some additional investigation is required this will inevitably lead to a delay.

This scheme is based upon the sources and the risks identified in the phase 1 desktop study and sets out the details for, where relevant, the monitoring, sampling and testing of soil, vapour, ground gas, surface and groundwater.

This can be prepared and submitted with the phase 1 desktop study.

Phase 2 – Intrusive Site Investigation

If potential risks are identified in Phase 1, an intrusive investigation will be required. This can include:

- Boreholes, trial pits, and soil sampling.

- Groundwater and surface water sampling.

- Ground gas and vapour monitoring.

- Laboratory analysis of samples to determine concentrations of contaminants.

The risk assessment will be revised based on detected contamination levels.

If no significant contamination is found then no remediation is required. It will however be necessary to confirm to the LPA on completion that no unexpected contamination was found during the works, if any is found then remedial works will be required.

If significant contamination is found then a remediation strategy will be required.

Phase 3 – Remediation Strategy

If contamination is found to pose a risk, a remediation strategy will be required to detail how the contamination will be addressed. This can involve:

- Selecting appropriate remediation techniques based on the type and extent of contamination.

- Designing and detailing the remediation process.

- Detailing any monitoring testing required during remediation.

- Proposing a post-remediation verification plan to demonstrate satisfactory remediation.

We will provide you with a check sheet of the information we will need from you for the verification so that this can be collected during the works so that the verification report can be completed and submitted as speedily as possible.

Phase 4 – Verification

Once the strategy is approved, remediation can commence. After remediation, a Verification Report must be produced to confirm satisfactory completion of the remediation. The report provides evidence, such as site levels before, during and after, certification of soils brought to site, validation sampling results, to demonstrate that the site has been successfully remediated to an acceptable level.

Timescale

Each phase must be submitted to the LPA to demonstrate that the planning condition has been satisfied.

The phase 1 desktop and site investigation scheme can be prepared and submitted together. Our standard turn round for these is fifteen working days but this can be reduced if required.

The time required for the phase 2 will depend on the scope, for near surface soil sampling the time from instruction to issue of the report could be four weeks. If ground gas monitoring is required, assuming three weeks lead in for the rig to drill boreholes, six rounds of monitoring at weekly intervals and a week to complete the report, the time from instruction to issue of the report may be ten weeks. Complex sites may require much longer with perhaps an initial investigation to identify areas that require a more detailed investigation.

Other considerations

Liaison with Regulatory Bodies: It might be necessary to engage with regulatory bodies such as the Environment Agency (EA) or Natural Resources Body for Wales.

Long-term monitoring: In some cases, long-term monitoring of groundwater or gases might be necessary even after remediation.

It's worth noting that the above is a general outline, and the specifics might vary depending on the LPA and the site's unique circumstances. Always refer to the exact wording of the planning condition.

We are Here to Help

Due to the technical nature of contamination assessments and remediation, it is crucial to engage with experienced contaminated land consultants. You can download our flowchart from our resources page. It is never too early to contact us (020 8291 1354) (askgo@gosolve.co.uk) to discuss your project.

Water Shortages & SuDS in a Soggy Summer

It may seem odd to be talking water shortage in a very soggy summer but the fact of the matter is that water shortages are an issue in some areas and will only increase with time.

As an illustration MP for South Cambridgeshire, Anthony Browne appears to be unimpressed with the government’s development plans for the area: “unless the Government can say where the water will come from, it’s plans are dead on arrival”.

Is the answer more reservoirs? In some cases that will obviously help. More long term we need a more rational approach to the use of water, both the water in our taps and the water that falls from the sky.

Building regulations are slowly making dwellings more water efficient by requiring designers to utilise a range of water reducing features to new properties. Of course we can all do our bit by getting out that watering can rather than the hose.

Considering rainfall we are slowing awaking to the realisation that trying to get rainwater into the sewers as quickly as possible and thereby often causing flooding downstream may not be the brightest idea. This is where Sustainable Drainage Systems (SuDS) come in, where the aim is both to recharge the aquifers from which we draw so much of our drinking water and retain water for use on site. Where these outcomes are not possible a range of options are available to reduce the potential for flooding. These range from green, brown or blue rooves, water butts and rain gardens to attenuation tanks fitted with flow control. There is more information on our Drainage Strategy page.

By all means give me Peter George a call (07765 232995) or email (SuDS@gosolve.co.uk) if you wish to discuss your project.

Is Brownfield First at Risk With Labour?

Some headlines might give that impression. What Sir Kier said is more nuanced. An article on the BBC news website provides more background:

"In an interview with BBC Breakfast, Sir Keir gave an example of homes being built on a playing field rather than a car park because the car park was technically within the green belt.

"We would make those tough choices and say to local areas, notwithstanding that it's greenbelt, if it's a car park or similar land which doesn't affect the beauty of our countryside… then we'll change the planning rules, we'll give you the powers to do that," he said."

The full article is here

CHAS Advanced Accreditation

GO Contaminated Land Solutions is pleased to announce that we have obtained CHAS Advanced Accreditation. CHAS is the Contractors Health and Safety Scheme. It is trusted as the leading provider of compliance and risk management solutions in the UK, setting benchmarks across a number of industries. These include construction, housing and development.

We are proud to be joining the CHAS database of contractors, reassuring prospective clients and collaborators of our compliance in areas such as Health & Safety, Environmental and Insurance, as well as regulations such as CDM 2015.

The official mark of compliance offered by the CHAS Advanced Accreditation allows us to pre qualify for projects, saving valuable time for companies who would like to work with us. The assessment of a contractor’s health and safety standards can be a lengthy process for a potential client; accreditation by CHAS makes this unnecessary!

More information can be found here : www.chas.co.uk

Environmental Outcome Reports (EOR)

The government are currently running a consultation on a new scheme to replace Environmental Impact Assessment (EIA). They state:

"Part 6 of the Levelling Up and Regeneration Bill will secure powers to implement a new system of environmental assessment known as Environmental Outcomes Reports. This will allow the government to replace the EU-derived Strategic Environmental Assessment and Environmental Impact Assessment processes with a streamlined system that places greater focus on delivering our environmental ambitions.

The introduction of outcomes-based approach to the Environmental Outcomes Reports allows the government to reflect its environmental priorities directly into plan-making and decision-making process on the largest developments. The feedback from this consultation will help us establish our approach to developing these environmental outcomes across government."

The consultation advises that:

"Outcomes should:

- drive the achievement of statutory environmental targets and the Environment Improvement Plan

- be measurable using indicators at the correct scale ...

- be designed using the knowledge and experience of sector groups and environmental experts

- have an organisation responsible for monitoring overall progress of specific outcomes i.e., a responsible ‘owner’

- be reviewed on a regular basis to ensure they remain relevant

- not duplicate matters more effectively addressed through policy.

You can find out more and take part at DLHC.